Use these links to rapidly review the documentTABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrantý | ||

Filed by a Party other than the Registranto | ||

Check the appropriate box: | ||

Preliminary Proxy Statement | ||

o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

Definitive Proxy Statement | ||

o | Definitive Additional Materials | |

o | Soliciting Material under §240.14a-12 | |

| Bristol-Myers Squibb Company | ||||

(Name of Registrant as Specified In Its Charter) | ||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) | ||||

Payment of Filing Fee (Check the appropriate box): | ||||

ý | No fee required. | |||

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | |||

| (2) | Aggregate number of securities to which transaction applies: | |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| (4) | Proposed maximum aggregate value of transaction: | |||

| (5) | Total fee paid: | |||

o | Fee paid previously with preliminary materials. | |||

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

(1) | Amount Previously Paid: | |||

| (2) | Form, Schedule or Registration Statement No.: | |||

| (3) | Filing Party: | |||

| (4) | Date Filed: | |||

![]()

March 19, 2014, 2015

| NOTICE OF MEETING AND PROXY STATEMENT TUESDAY, MAY AT 10:00 A.M. BRISTOL-MYERS SQUIBB COMPANY 777 SCUDDERS MILL RD. PLAINSBORO NEW JERSEY | DEARFELLOWSTOCKHOLDER: You are cordially invited to attend the Annual Meeting of Stockholders of Bristol-Myers Squibb Company at our offices located in Plainsboro, New Jersey, on Tuesday, May These materials include the Notice of Annual Meeting and the Proxy Statement. The Proxy Statement describes the business to be transacted at the meeting and provides other information about the company that you should know when you vote your shares. The principal business of the Annual Meeting will be:

(i) the election of directors;

(ii) an advisory vote to approve the compensation of our named executive officers; (iii) the ratification of the appointment of an independent registered public accounting firm; (iv) the consideration of two amendments to our Amended and

Restated Certificate of Incorporation; and (v) the consideration of one stockholder proposal. We will also review the status of the company's business at the meeting. Last year, over Please follow the instructions in the Proxy Statement on how to attend the Annual Meeting. Admission to the Annual Meeting will be by ticket only.Please bring photo identification. We have provided space on the proxy card for comments from our registered stockholders. We urge you to use it to let us know your feelings about BMS or to bring a particular matter to our attention. If you hold your shares through an intermediary or received the proxy materials electronically, please feel free to write directly to us. | |||||

|  | |||||

JAMES M. CORNELIUS | LAMBERTO ANDREOTTI | |||||

| Chairman of the Board | Chief Executive Officer and Chairman-Designate |

![]()

345 Park Avenue

New York, New York 10154-0037

NOTICE OF ANNUAL MEETING

OF STOCKHOLDERS

Notice is hereby given that the 20142015 Annual Meeting of Stockholders will be held at Bristol-Myers Squibb Company, 777 Scudders Mill Road, Plainsboro, New Jersey, on Tuesday, May 6, 2014,5, 2015, at 10:00 a.m. for the following purposes as set forth in the accompanying Proxy Statement:

Holders of record of our common and preferred stock at the close of business on March 14, 201413, 2015 will be entitled to vote at the meeting.

| By Order of the Board of Directors | ||

| SANDRALEUNG General Counsel and Corporate Secretary |

Dated: March 19, 2014, 2015

Regardless of the number of shares you own, your vote is important. If you do not attend the Annual Meeting to vote in person, your vote will not be counted unless a proxy representing your shares is presented at the meeting. To ensure that your shares will be voted at the meeting, please vote in one of these ways:

If you do attend the Annual Meeting, you may revoke your proxy and vote by ballot.

2015 Annual Meeting of Stockholders

| Date: | Tuesday, May 5, 2015 | |

| Time: | 10:00 a.m. | |

| Place: | 777 Scudders Mill Road, Plainsboro, New Jersey |

| Voting Matters | ||||||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| Item | Proposal | Board Vote Recommendation | Required Vote | Page Number | ||||

| 1 | Election of Directors | FOR ALL | Majority of votes cast | 14 | ||||

| 2 | Advisory vote to approve the compensation of our named executive officers | FOR | Majority of shares voted | 71 | ||||

| 3 | Ratification of the appointment of an independent registered public accounting firm | FOR | Majority of shares voted | 72 | ||||

| 4 | Approval of Amendment to our Amended and Restated Certificate of Incorporation to designate Delaware Chancery Court as the exclusive legal forum for certain legal actions | FOR | Majority of outstanding shares | 75 | ||||

| 5 | Approval of Amendment to our Amended and Restated Certificate of Incorporation to remove the supermajority voting provisions applicable to Preferred Stockholders | FOR | Majority of outstanding sharesAND 2/3 of outstanding preferred shares | 76 | ||||

| 6 | Stockholder proposal on shareholder action by written consent | AGAINST | Majority of shares voted | 77 | ||||

| | | | | | | | | |

| Nominees for Board of Directors | ||||||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| Name | Occupation | Independent | Committee Memberships* | Other Public Company Boards | ||||

Lamberto Andreotti | Chief Executive Officer and Chairman-Designate of the Company | No | | 1 | ||||

Giovanni Caforio, M.D. | Chief Operating Officer and CEO-Designate of the Company | No | 0 | |||||

| Former Chairman and Chief Executive Officer of Textron Inc. and Navistar International Corporation | Yes | CDCG (c); CMDC | 2 | ||||

Laurie H. Glimcher, M.D. | Dean of Weill Cornell Medical College and the Cornell University Provost for Medical Affairs | Yes | Audit; S&T | 1 | ||||

Michael Grobstein | Former Vice Chairman of Ernst & Young LLP | Yes | Audit; CMDC | 1 | ||||

Alan J. Lacy | Former Chairman and Chief Executive Officer, Sears, Roebuck and Co. | Yes | Audit (c); CDCG | 1 | ||||

Thomas J. Lynch, Jr., M.D. | Director of Yale Cancer Center; Professor of Internal Medicine, Yale Cancer Center, Yale School of Medicine; and Physician-in-Chief of Smilow Cancer Hospital, Yale-New Haven | Yes | CDCG; S&T | 0 | ||||

Dinesh C. Paliwal | Chairman, President and Chief Executive Officer of Harman International Industries, Inc. | Yes | Audit; CDCG | 1 | ||||

Vicki L. Sato, Ph.D. | Professor of Management Practice at the Harvard Business School | Yes | CMDC; S&T (c) | 2 | ||||

Gerald L. Storch | Chief Executive Officer of Hudson's Bay Company | Yes | Audit; CMDC | 1 | ||||

Togo D. West, Jr. | Chairman of TLI Leadership Group and Former U.S. Secretary of Veterans Affairs | Yes | CDCG; CMDC (c) | 2 | ||||

| | | | | | | | | |

* Audit: Audit Committee | ||||||||

CDCG: Committee on Directors and Corporate Governance | (c): Committee Chair | |||||||

CMDC: Compensation and Management Development Committee | ||||||||

S&T: Science and Technology Committee | ||||||||

| | | | | | | | | |

Corporate Governance Highlights

The Committee on Directors and Corporate Governance continually reviews corporate governance issues and is responsible for identifying and recommending corporate governance initiatives. Below are some significant corporate governance features and best practices that the Company has adopted:

Annual election of Directors |

Semi-annual disclosure of | |||||||

• Majority voting standard and resignation policy for election of Directors | • Director retirement policy (age 75) | |||||||

• Ability for stockholders to call a special meeting (25%) | • Clawback and recoupment policies | |||||||

• No supermajority voting provisions for common stockholders | • Share ownership and retention policy | |||||||

• No stockholder rights plan | • Limit on number of | public company directorships Board members may hold (4) | ||||||

• Extensive related party transaction policies and procedures |

| Active stockholder engagement | ||||||

• Prohibition of speculative and hedging transactions by all employees and directors |

| |||||||

Annual | review of Corporate Governance Guidelines | |||||||

Stockholder Engagement

Bristol-Myers Squibb values the views of its stockholders. In 2014, members of management met with institutional stockholders holding a substantial portion of our outstanding shares to discuss the Company's executive compensation program and general corporate governance issues. We received valuable and generally positive feedback from these meetings, which is described in more detail on page 32.

Executive Compensation

Our Compensation Discussion and Analysis can be found on page 29 of the Proxy Statement.

Performance Graph

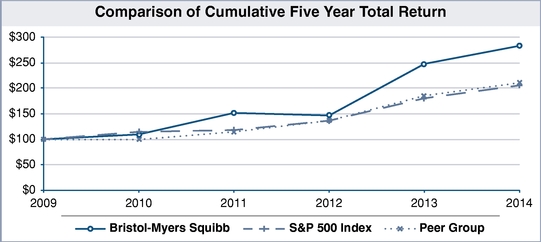

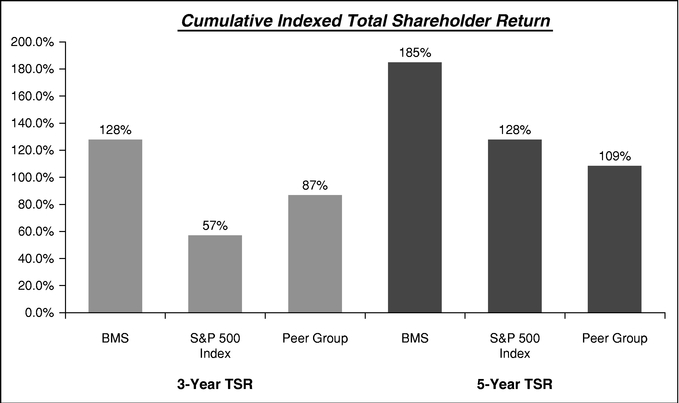

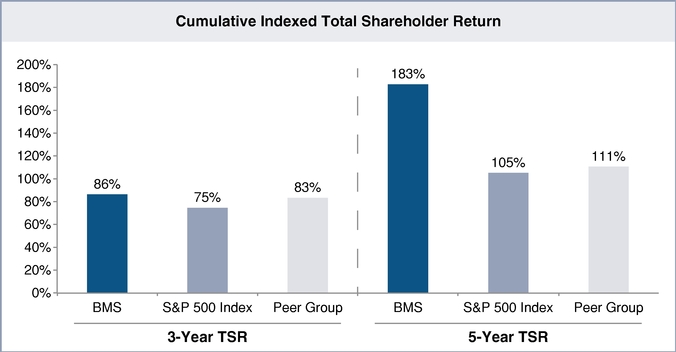

The following performance graph compares the performance of Bristol-Myers Squibb for the periods indicated with the performance of the Standard & Poor's 500 Stock Index (S&P 500) and the average performance of our executive compensation extended peer group which is listed on page 35 of this Proxy Statement.

Assumes $100 invested on December 31, 2008 in Bristol-Myers Squibb common stock, S&P 500 Index and the peer group. Values are as of December 31 of specified year assuming dividends are reinvested. Total return indices reflect reinvested dividends and are weighted using beginning-period market capitalization for each of the reported time periods.

![]()

PROXY STATEMENT

| | Page | |

|---|---|---|

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING | 1 | |

CORPORATE GOVERNANCE AND BOARD MATTERS | ||

Board's Role in Strategic Planning and Risk Oversight | ||

Director Independence | 7 | |

Board Leadership Structure | ||

Meetings of our Board | ||

Annual Meeting of Stockholders | ||

Committees of our Board | ||

Compensation Committee Interlocks and Insider Participation | ||

Risk Assessment of Compensation Policies and Practices | ||

Criteria for Board Membership | ||

Identification and Selection of Nominees for our Board | ||

Stockholder Nominations for Director | ||

Information on Nominees for Directors | ||

Communications with our Board of Directors | ||

Codes of Conduct | ||

Related Party Transactions | ||

Availability of Corporate Governance Documents | ||

Compensation of Directors | ||

VOTING SECURITIES AND PRINCIPAL HOLDERS | ||

Common Stock Ownership by Directors and Executive Officers | ||

Principal Holders of Voting Securities | ||

Section 16(a) Beneficial Ownership Reporting Compliance | ||

Policy on Hedging and Pledging | ||

EXECUTIVE COMPENSATION | ||

Compensation Discussion and Analysis | ||

Compensation and Management Development Committee Report | ||

Summary Compensation Table | ||

Grants of Plan-Based Awards | ||

Outstanding Equity Awards at Fiscal Year-End | ||

Option Exercises and Stock Vesting | ||

Present Value of Accumulated Pension Benefits | ||

Non-Qualified Deferred Compensation | ||

Post-Termination Benefits | ||

Termination of Employment Obligations (Excluding Vested Benefits) | ||

ITEMS TO BE VOTED UPON | ||

Item 1—Election of Directors | ||

Item 2—Advisory Vote to Approve the Compensation of our Named Executive Officers | 71 | |

Equity Compensation Plan Information | 72 | |

Item 3—Ratification of the Appointment of Independent Registered Public Accounting Firm | ||

Audit and Non-Audit Fees | ||

Pre-Approval Policy for Services Provided by our Independent Registered Public Accounting Firm | ||

Audit Committee Report | ||

| ||

| ||

Item 4— | ||

Item 5—Approval of Amendment to our Amended and Restated Certificate of Incorporation to Remove the Supermajority Provisions Applicable to Preferred Stockholders | 76 | |

Item 6—Stockholder Proposal on Shareholder Action by Written Consent | 77 | |

OTHER MATTERS | ||

Exhibit A—Categorical Standards of Independence | A-1 | |

Exhibit B—Certificate of Amendment to Amended and Restated Certificate of Incorporation—exclusive forum provision | B-1 | |

Exhibit C—Certificate of Amendment to Amended and Restated Certificate of Incorporation—supermajority voting applicable to preferred stockholders | C-1 | |

DIRECTIONS TO OUR PLAINSBORO OFFICE Inside Back Cover | ||

GENERAL INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why am I receiving these materials?

This Proxy Statement is being delivered to all stockholders of record as of the close of business on March 14, 201413, 2015 in connection with the solicitation of proxies on behalf of the Board of Directors for use at the Annual Meeting of Stockholders on May 6, 2014.5, 2015. We expect our proxy materials, including this Proxy Statement and the Annual Report, to be first made available to stockholders on or about March 19, 2014., 2015. Although the Annual Report and Proxy Statement are being delivered together, the Annual Report should not be deemed to be part of the Proxy Statement.

What is "Notice and Access" and how does it affect me?

The U.S. Securities and Exchange Commission (SEC) has adopted a "Notice and Access" model which permits us to provide proxy materials to our stockholders electronically by posting the proxy materials on a publicly accessible website. Delivering proxy materials electronically will conserve natural resources and save us money by reducing printing and mailing costs. Accordingly, we have sent to most of our stockholders a "Notice of Internet Availability of Proxy Materials." This Notice provides instructions on how to access our proxy materials online and, if you prefer receiving a paper copy of the proxy materials, how you can request one. Employees and pension plan participants who have given consent to receive materials electronically received a link to access our proxy materials by email. We encourage all of our stockholders who currently receive paper copies of the proxy materials to elect to view future proxy materials electronically if they have Internet access. You can do so by following the instructions when you vote your shares online or, if you are a beneficial holder, by asking your bank, broker or other holder of record how to receive proxy materials electronically.

What is "householding" and how does it work?

"Householding" is a procedure we adopted whereby stockholders of record who have the same last name and address and who receive the proxy materials by mail will receive only one copy of the proxy materials unless we have received contrary instructions from one or more of the stockholders. This procedure reduces printing and mailing costs. If you wish to receive a separate copy of the proxy materials, now or in the future, at the same address, or if you are currently receiving multiple copies of the proxy materials at the same address and wish to receive a single copy, you may contact us by writing to Stockholder Services, Bristol-Myers Squibb Company, 345 Park Avenue, New York, New York 10154, or by calling us at (212) 546-3309.

If you are a beneficial owner (your shares are held in the name of a bank, broker or other holder of record), the bank, broker or other holder of record may deliver only one copy of the Proxy Statement and Annual Report, or Notice of Internet Availability of Proxy Materials, to stockholders who have the same address unless the bank, broker or other holder of record has received contrary instructions from one or more of the stockholders. If you wish to receive a separate copy of the Proxy Statement and Annual Report, or Notice of Internet Availability of Proxy Materials, now or in the future, you may contact us at the address or phone number above and we will promptly deliver a separate copy. Beneficial owners sharing an address who are currently receiving multiple copies of the Proxy Statement and Annual Report, or Notice of Internet Availability of Proxy Materials, and wish to receive a single copy in the future, should contact their bank, broker or other holder of record to request that only a single copy be delivered to all stockholders at the shared address in the future.

Who can attend the Annual Meeting?

Only stockholders of Bristol-Myers Squibb as of the record date, March 14, 2014,13, 2015, their authorized representatives and guests of Bristol-Myers Squibb may attend the Annual Meeting. Admission will be by ticket only. A form of government-issued photograph identification will be required to enter the meeting. Large bags, backpacks, briefcases, cameras, recording equipment and other electronic devices will not be permitted in the meeting, and attendees will be subject to security inspections. Our

offices are wheelchair accessible. We will provide, upon request, wireless headsets for hearing amplification.

How do I receive an admission ticket?

If you are a registered stockholder (your shares are held in your name) and plan to attend the meeting, you should bring either the Notice of Internet Availability of Proxy Materials or the top portion of the proxy card, both of which will serve as your admission ticket.

If you are a beneficial owner (your shares are held in the name of a bank, broker or other holder of record) and plan to attend the meeting, you can obtain an admission ticket in advance by writing to Stockholder Services, Bristol-Myers Squibb Company, 345 Park Avenue, New York, New York 10154. Please be sure to enclose proof of ownership, such as a bank or brokerage account statement. Stockholders who do not obtain tickets in advance may obtain them upon verification of ownership at the Registration Desk on the day of the Annual Meeting.

We may also issue tickets to other individuals at our discretion.

All holders of record of our $0.10 par value common stock and $2.00 convertible preferred stock at the close of business on March 14, 201413, 2015 will be entitled to vote at the 20142015 Annual Meeting. Each share is entitled to one vote on each matter properly brought before the meeting.

How do I vote if I am a registered stockholder?

Proxies are solicited to give all stockholders who are entitled to vote on the matters that come before the meeting the opportunity to do so whether or not they attend the meeting in person. If you are a registered holder, you can vote your shares by proxy in one of the following manners:

Choosing to vote via Internet or calling the toll-free number listed above will save us expense. In order to vote online or via telephone, have the voting form in hand and either call the number or go to the website and follow the instructions. If you vote via the Internet or by telephone, please do not return a signed proxy card.

If you received a paper copy of the proxy materials and choose to vote by mail, specify how you want your shares voted on each proposal by marking the appropriate boxes on the proxy card enclosed with the Proxy Statement, date and sign it, and mail it in the postage-paid envelope.

If you wish to vote in person, you can vote your shares at the Annual Meeting.

How do I vote if I am a beneficial stockholder?

If you are a beneficial stockholder, you have the right to direct your broker or nominee on how to vote the shares. You should complete a voting instruction card which your broker or nominee is obligated to provide you. If you wish to vote in person at the meeting, you must first obtain from the record holder a legal proxy issued in your name.

Under the rules of the New York Stock Exchange (NYSE), brokers that have not received voting instructions from their customers ten days prior to the meeting date may vote their customers' shares in the brokers' discretion on the proposals regarding routine matters, which in most cases includes the ratification of the appointment of the independent registered public accounting firm.

Under NYSE rules, the election of directors, the advisory vote to approve the compensation of our named executive officers, the approval of two amendments to our Amended and Restated Certificate of Incorporation and the approval of any stockholder proposals are considered "non-discretionary" items, which means that your broker cannot vote your shares on these proposals.

What items will be voted upon at the Annual Meeting?

At the Annual Meeting, we will consider and act on the following items of business:

We do not know of any other matter that may be brought before the meeting. However, if other matters are properly presented for action, it is the intention of the named proxies to vote on them according to their best judgment.

What are the Board of Directors' voting recommendations?

For the reasons set forth in more detail later in the Proxy Statement, our Board of Directors recommends a vote FOR the election of each director, FOR the advisory vote to approve the compensation of our named executive officers, FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for 20142015, FOR each of the two amendments to our Amended and FOR the advisory vote to approve the compensationRestated Certificate of our named executive officers. The Board of Directors has decided not to take a position FOR orIncorporation and AGAINST the stockholder proposal on simple majority vote.proposal.

How will my shares be voted at the Annual Meeting?

The individuals named as proxies on the proxy card will vote your shares in accordance with your instructions. Please review the voting instructions and read the entire text of the proposals and the positions of the Board of Directors in the Proxy Statement prior to marking your vote.

If your proxy card is signed and returned without specifying a vote or an abstention on a proposal, it will be voted according to the recommendation of the Board of Directors on that proposal. That recommendation is shown for each proposal on the proxy card. With respect to the shareholder proposal on simple majority vote, in the absence of voting instructions to the contrary, shares represented by validly executed proxies will be voted ABSTAIN.

How many votes are needed to elect the directors and to approve each of the proposals?

Director Elections: A majority of votes cast with respect to each director's election at the meeting is required to elect each director. A majority of the votes cast means that the number of votes cast "for" a director must exceed the number of votes cast "against" that director in order for the director to be elected. Abstentions will not be counted as votes cast for or against the director and broker non-votes will have no effect on this proposal.

Ratification of our Auditors: The affirmative vote of a majority of our outstanding shares present in person or by proxy and entitled to vote on the matter is required for the ratification of the appointment of our independent registered public accounting firm. Abstentions will be counted as votes against this proposal. As described above, a broker or other nominee may generally vote on routine matters such as this one, and therefore no broker non-votes are expected to exist in connection with this proposal.

Advisory Vote: The affirmative vote of a majority of our outstanding shares present in person or by proxy and entitled to vote on the matter is required for the approval of the advisory vote to approve the compensation of our named executive officers. Because your vote is advisory, it will not be binding upon our Board of Directors. Abstentions will be counted as votes against this proposal and broker non-votes will have no effect on this proposal.

Ratification of our Auditors: The affirmative vote of a majority of our outstanding shares present in person or by proxy and entitled to vote on the matter is required for the ratification of the appointment of our independent registered public accounting firm. Abstentions will be counted as votes against this

proposal. As described above, a broker or other nominee may generally vote on routine matters such as this one, and therefore no broker non-votes are expected to exist in connection with this proposal.

Exclusive Forum Provision: The affirmative vote of the holders of a majority of our outstanding shares entitled to vote on the matter is required to approve the Certificate of Amendment to our Amended and Restated Certificate of Incorporation to designate the Court of Chancery of the State of Delaware as the sole and exclusive forum for specified legal actions, unless otherwise consented to by the company. Abstentions and broker non-votes will be counted as votes against this proposal.

Removal of Supermajority Voting Provisions: Both the affirmative vote of the holders of a majority of our outstanding shares entitled to vote on the matter and the affirmative vote of the holders of at least two-thirds of our outstanding shares of preferred stock is required to approve the Certificate of Amendment to our Amended and Restated Certificate of Incorporation to eliminate the supermajority voting provisions applicable to preferred stockholders. Abstentions and broker non-votes will be counted as votes against the proposal.

Stockholder Proposal: The affirmative vote of a majority of our outstanding shares present in person or by proxy and entitled to vote on the matter is required for the approval of the stockholder proposal, if presented at the meeting. Abstentions will be counted as votes against this proposal and broker non-votes will have no effect on this proposal.

In accordance with the laws of Delaware, our Amended and Restated Certificate of Incorporation and our Bylaws, for all matters being submitted to a vote of stockholders, only proxies and ballots that indicate votes "FOR," "AGAINST" or "ABSTAIN" on the proposals, or that provide the designated proxies with the right to vote in their judgment and discretion on the proposals are counted to determine the number of shares present and entitled to vote. Broker non-votes are not counted as shares present and entitled to vote but will be counted for purposes of determining quorum (whether enough votes are present to hold the Annual Meeting).

Can I change my vote after I return the proxy card, or after voting by telephone or electronically?

If you are a stockholder of record, you can revoke your proxy at any time before it is voted at the meeting by taking one of the following three actions:

If you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker or other holder of record. You may also vote in person at the Annual Meeting if you obtain a legal proxy.

All shares that have been properly voted and not revoked will be voted at the Annual Meeting.

If you wish to give your proxy to someone other than the persons named as proxies in the enclosed form of proxy, you may do so by crossing out the names of all three persons named as proxies on the proxy card and inserting the name of another person. The signed card must be presented at the meeting by the person you have designated on the proxy card.

An independent agent tabulates the proxies and the votes cast at the meeting. In addition, independent inspectors of election certify the results of the vote tabulation.

Yes, any information that identifies a stockholder or the particular vote of a stockholder is kept confidential.

Who will pay for the costs involved in the solicitation of proxies?

We will pay all costs of preparing, assembling, printing and distributing the proxy materials as well as the solicitation of all proxies. We have retained Georgeson Shareholder Communications Inc. to assist in soliciting proxies for a fee of $18,000, plus reasonable out-of-pocket expenses. We may solicit proxies on behalf of the Board of Directors through the mail, in person, electronically, and by telecommunications. We will, upon request, reimburse brokerage firms and others for their reasonable expenses incurred for forwarding solicitation material to beneficial owners of stock.

CORPORATE GOVERNANCE AND BOARD MATTERS

Our business is managed under the direction of our Board of Directors pursuant to the Delaware General Corporation Law and our Bylaws. The Board has responsibility for establishing broad corporate policies and for the overall performance of our company. The Board is kept advised of company business through regular written reports and analyses and discussions with the CEO and other officers of Bristol-Myers Squibb, by reviewing materials provided to them and by participating in Board and Board Committee meetings.

The Committee on Directors and Corporate Governance continually reviews corporate governance issues and is responsible for identifying and recommending the adoption of corporate governance initiatives. In addition, our Compensation and Management Development Committee regularly reviews compensation issues and recommends adoption of policies and procedures that strengthen our compensation practices. The Compensation Discussion and Analysis beginning on page 2729 discusses many of these policies and procedures.

Listed below are some of the significant corporate governance initiatives we have adopted:

other payments made to trade associations to which we give $50,000 or more that can be attributed to lobbying expenditures.

The Board of Directors has adopted Corporate Governance Guidelines that govern its operation and that of its Committees. FromOur Board annually reviews our Corporate Governance Guidelines and, from time to time, our Board revises the Corporate Governance Guidelinesthem in response to changing regulatory requirements, evolving best practices and the concerns of our stockholders and other constituents. Our Corporate Governance Guidelines may be viewed on our website at www.bms.com/ourcompany/governance.

Board's Role in Strategic Planning and Risk Oversight

Our Board meets regularly to discuss the strategic direction and the issues and opportunities facing our company in light of trends and developments in the biopharmaceutical industry and general business environment. Our Board has been instrumental in determining our strategy to further evolve our business model to become a leadingdiversified specialty biopharmaceutical company. Throughout the year, our Board provides guidance to management regarding our strategy and helps to refine our operating plans to implement our strategy. Each year, typically during the second quarter, the Board holds an extensive meeting with senior management dedicated to discussing and reviewing our long-term operating plans and overall corporate strategy. A discussion of key risks to the plans and strategy as well as risk mitigation plans and activities is led by our Chief Executive Officer as part of the meeting. The involvement of the Board in setting our business strategy is critical to the determination of the types and appropriate levels of risk undertaken by the company. As stated in our Corporate Governance Guidelines, our Board is responsible for risk oversight as part of its fiduciary duty of care to effectively monitor business operations.operations effectively. Our Board administers its strategic planning and risk oversight function as a whole and through its Board Committees. For example, theThe following are examples of how our Board Committees are involved in this process:

It is the policy of our Board that a substantial majority of its members be independent from management, and the Board has adopted independence standards that meet the listing standards of the New York Stock Exchange. In accordance with our Corporate Governance Guidelines, our Board undertook its annual review of director independence. Our Board considered any and all commercial and charitable relationships of directors, including transactions and relationships between each director or any member of his or her immediate family and Bristol-Myers Squibb and its subsidiaries, which are described more fully below. Following the review, our Board determined, by applying the independence standards contained in the Corporate Governance Guidelines, that each of our directors and each

director nominee for election at this Annual Meeting is independent of Bristol-Myers Squibb and its management in that none has a direct or indirect material relationship with our company, except for Lamberto Andreotti.Andreotti and Giovanni Caforio, M.D. Mr. Andreotti isand Dr. Caforio are not considered an independent directordirectors because he isthey are currently employed by our company.

In determining that each of Lewis B. Campbell, James M. Cornelius, Laurie H. Glimcher, M.D., Michael Grobstein, Alan J. Lacy, Thomas J. Lynch, Jr., M.D., Dinesh C. Paliwal, Vicki L. Sato, Ph.D., Gerald L. Storch and Togo D. West, Jr. is independent, the Board considered the following relationships which were deemed immaterial under our categorical standards (see Exhibit A):

Additionally, in determining whether Mr. Cornelius and Mr. Grobstein meetour directors met the applicable independence standards, the Board considered certain payments made to, and certain payments received from, our former subsidiary Mead Johnson Nutrition Company. Mr. Cornelius serves as the non-executive chairman of the board of directors of Mead Johnson and Mr. Grobstein began serving as a member of the board in February 2014. The Board also considered payments we made to a private company where the following relationships which did not fall under our categorical standards:

The Board determined that none of these relationships impairs Mr. Cornelius' or Mr. Grobstein'sthe independence of these directors under the New York Stock Exchange's independence standards or otherwise.

The company's governance documents provide the Board with flexibility to select the appropriate leadership structure for the company. They establish well-defined responsibilities with respect to the Chairman and Lead Independent Director roles, including the requirement that the Board have a Lead Independent Director if the Chairman is not an independent director. This information is set forth in more detail on our website at www.bms.com/ourcompany/governance.

On January 20, 2015, we announced the following organizational and Board leadership changes:

James M. Corneliusthrough August 3, 2015 during which he will be working closely with our new Chief Executive Officer;

The Board has determined to elect a three-year period after his retirement,Lead Independent Director when Mr. Cornelius wasAndreotti becomes our Chairman because Mr. Andreotti will not considered to be an independent director under the independence standards set forth in our Corporate Governance Guidelines (which meet the listing standards of the New York Stock Exchange)Exchange standards of independence due to his priorcurrent service as Chief Executive Officer of the company. During that time, the Board determined that it was appropriate to maintain aThe Lead Independent Director is selected annually by the independent directors. The Lead Independent Director's responsibilities include, among others, presiding at the meetings of independent directors, approving meeting agendas and Lewis B. Campbell,meeting schedules, approving and advising the current ChairChairman as to the quality, quantity and timeliness of information sent to the Board and serving as the principal liaison and facilitator between the independent directors and the Chairman. A more detailed description of the Committee on Directorsroles and Corporate Governance, was annually selected by the Board to serve asresponsibilities of the Lead Independent Director. As noted above, Mr. CorneliusDirector is now independent. As such, the Board determined that aavailable on our website at www.bms.com/ourcompany/governance.

In determining our next Chairman, Chief Executive Officer and Lead Independent Director, role was no longer necessary or required under our Guidelines, and Mr. Campbell stepped down from that role and continues to serve as an independent director. We continue to separate the positions of Chairman and CEO.

In making these Board leadership structure determinations, the Board consideredgave thoughtful and significant consideration to many factors, including the specific needs of the Board and the business, our Corporate Governance Guidelines and the best interests of our stockholders. Our Board believes that in the context of the upcoming transition to a new Chief Executive Officer, it will be in the best interests of the company to have our former Chief Executive Officer become Chairman and work closely with our new Chief Executive Officer to ensure a seamless transition of leadership to support our continued evolution to a diversified specialty biopharma company. In accordance with our Corporate Governance Guidelines, the Board recognized the importance of having a Lead Independent Director to maintain a strong counterbalancing structure to ensure that the Board functions in an appropriately independent manner. The Board believes this structure will continue to provide an effective, high-functioning Board as well as appropriate safeguards and oversight. Our Board will continue to evaluate its leadership structure in light of changing circumstances and will evaluate the Board's leadership structure on at least an annual basis and make changes at such times as it deems appropriate.

Our Board meets on a regularly scheduled basis during the year to review significant developments affecting Bristol-Myers Squibb and to act on matters requiring Board approval. It also holds special meetings when important matters require Board action between scheduled meetings. Members of senior management regularly attend Board meetings to report on and discuss their areas of responsibility. In 2013,2014, the Board of Directors met 7eight times. The average aggregate attendance of directors at Board and committee meetings was over 94%96%. No director attended fewer than 75% of the aggregate number of Board and committee meetings during the period he or she served, except that Mr. Paliwal attended three of the five (60%) Board and Committee on Directors and Corporate Governance meetings held since he joined the Board on July 1, 2013. Both of the meetings Mr. Paliwal missed were held on the same day and Mr. Paliwal had informed the company prior to joining the Board that he would be unable to attend these meetings due to a previously scheduled commitment.served. In addition, our independent directors met six times during 20132014 to discuss such topics as our independent directors determined, including the evaluation of the performance of our current Chief Executive Officer. The Lead Independent Director's responsibilities include, among others, presiding atOfficer as well as the meetingsselection of independent directorsour new Chief Executive Officer, Chairman and Mr. Campbell presided over these sessions while he served as our Lead Independent Director.

Annual Meeting of Stockholders

Directors are strongly encouraged, but not required, to attend the Annual Meeting of Stockholders. All of the 20132014 nominees for director attended our 20132014 Annual Meeting of Stockholders except for Mr. Andreotti (who was attending to a family emergency) and Dr. Glimcher (whoand Mr. Lacy who each had a long-standing previous commitment).commitments.

Our Bylaws specifically provide for an Audit Committee, Compensation and Management Development Committee, and Committee on Directors and Corporate Governance, which are composed entirely of independent directors. Our Board of Directors has determined, in its judgment, that all members of the Audit Committee are financially literate and that all members of the Audit Committee meet additional, heightened independence criteria applicable to directors serving on audit committees under the New York Stock Exchange listing standards. In addition, our Board has determined that Messrs. Grobstein, Lacy and Storch each qualify as an "audit committee financial expert" under the applicable SEC rules.

Our Bylaws also authorize the establishment of additional committees of the Board and, under this authorization, our Board of Directors established the Science and Technology Committee. Our Board has appointed individuals from among its members to serve on these four committees and each committee operates under a written charter adopted by the Board, as amended from time to time. These charters are published on our website at www.bms.com/ourcompany/governance. Each of these Board committees has the necessary resources and authority to discharge its responsibilities, including the authority to retain consultants or experts to advise the committee.

On March 7, 2013, the Board established a Securities Issuance Committee to determine and approve the terms and provisions of securities issued by the company during the fourth quarter of 2013. The members of the Securities Issuance Committee were James M. Cornelius, Lamberto Andreotti and Lewis B. Campbell. The Securities Issuance Committee met once during 2013.

The table below indicates the current members of our Board Committees and the number of meetings held in 2014:

Director |

| Audit | Committee on Directors and Corporate Governance | Compensation and Management Development | Science and Technology(4) | |||||

| | | | | | | | | | | |

| | | | | | | | | | | |

Lamberto Andreotti(1) | ||||||||||

Giovanni Caforio, M.D. | ||||||||||

Lewis B. Campbell | | C | X | | ||||||

James M. Cornelius(2) | ||||||||||

Laurie H. Glimcher, M.D. | X | | | X | ||||||

Michael Grobstein | X | X | ||||||||

Alan J. Lacy | C | X | | | ||||||

Thomas J. Lynch, Jr., M.D. | X | X | ||||||||

Dinesh C. Paliwal | X | X | | | ||||||

Vicki L. Sato, Ph.D. | X | C | ||||||||

Gerald L. Storch | X | | X | | ||||||

Togo D. West, Jr.(3) | X | C | ||||||||

Number of 2014 Meetings | 6 | 3 | 6 | 8 | ||||||

Audit Committee

The primary functions of this Committee are:

| |||||||||||||||||

| |||||||||||||||||

related work regarding our financial statements and the effectiveness of our internal control over financial reporting;

| |||||||||||||||||

| |||||||||||||||||

| |||||||||||||||||

Our Board of Directors has determined, in its judgment, that all members of the Audit Committee are financially literate and that all members of the Audit Committee meet additional, heightened independence criteria applicable to directors serving on audit committees under the New York Stock Exchange listing standards. In addition, our Board has determined that Messrs. Grobstein, Lacy and Storch each qualify as an "audit committee financial expert" under the applicable SEC rules.

Committee on Directors and Corporate Governance until his retirement from

The primary functions of this Committee are:

Compensation and Management Development Committee

The primary functions of this Committee are:

Science and Technology Committee until their retirements from the

The primary functions of this Committee are:

Beginning on May 6, 2014, the members and chairs of the Board's four committees will be as follows:

Compensation Committee Interlocks and Insider Participation

There were no Compensation and Management Development Committee interlocks or insider (employee) participation in 2013.2014.

Risk Assessment of Compensation Policies and Practices

We annually conduct a worldwide review of our material compensation policies and practices. Based on this review, we have concluded that our material compensation policies and practices are not reasonably likely to have a material adverse effect on the company. On a global basis, our compensation programs contain many design features that mitigate the likelihood of inducing excessive risk-taking behavior. These features include:

Our Corporate Governance Guidelines contain Board membership criteria that apply to nominees for a position on our Board of Directors, including candidates recommended by stockholders in accordance with the procedures described below. Under these criteria, members of our Board should be persons with broad experience in areas important to the operation of our company such as business, science, medicine, finance/accounting, law, business strategy, crisis management, corporate governance, education or government and should possess qualities reflecting integrity, independence, leadership, good business judgment, wisdom, an inquiring mind, vision, a proven record of accomplishment and an ability to work well with others. The Board believes that its membership should continue to reflect a diversity of gender, race and ethnicity.

Identification and Selection of Nominees for our Board

The Committee on Directors and Corporate Governance periodicallyregularly assesses the appropriate size and composition of our Board,Board. The Committee also considers succession planning for directors. When looking to identify and whether any vacancies on our Board are expected due to retirement or otherwise. In the event that vacancies are anticipated or otherwise arise,select a potential new director, the Committee on Directors and Corporate Governance considers candidates for Board membership. Candidates may come to the attention of the Committee on Directors and Corporate Governance through current Board members, third-party search firms, management, stockholders or others. The Chair of the Committee on Directors and Corporate Governance, in consultation with the Chairman, conducts an initial evaluation of the prospective nominees against the established Board membership criteria discussed above. The Committee reviews the skills of the current directors and compares them to the particular skills of potential candidates, keeping in mind its commitment to maintain a Board with members of diverse experience and background. Candidates may come to the attention of the Committee on Directors and Corporate Governance through current Board members, third-party search firms, management, stockholders or others. The Committee on Directors and Corporate Governance, in consultation with the Chairman, conducts an initial evaluation of the prospective nominees against the established Board membership criteria discussed above. Additional information relevant to the qualifications of prospective nominees may be requested from third-party search firms, other directors, management or other sources. After this initial evaluation, prospective nominees may be interviewed by telephone or in person by the Chairmembers of the Committee on Directors and Corporate Governance, the Chairman, the Lead Independent Director and other directors, as applicable. After completing this evaluation and interview, the Committee on Directors and Corporate Governance makes a recommendation to the full Board as to the persons who should be nominated by our Board, and the full Board determines the nominees after considering the recommendation and any additional information it may deem appropriate. Mr. Paliwal and Dr. Lynch, who joined the Board on July 1, 2013 and January 1, 2014 respectively, were initially identified as potential candidates for election to our Board by a third-party search firm retained by the Committee on Directors and Corporate Governance.

Stockholder Nominations for Director

The Committee on Directors and Corporate Governance considers and evaluates stockholder recommendations of nominees for election to our Board of Directors in the same manner as other director nominees. Stockholder recommendations must be accompanied by disclosure including written information about the recommended nominee's business experience and background with consent in writing signed by the recommended nominee that he or she is willing to be considered as a nominee and, if nominated and elected, he or she will serve as a director. Stockholders should send their written recommendations of nominees accompanied by the required documents to the principal executive offices of the company addressed to: Bristol-Myers Squibb Company, 345 Park Avenue, New York, New York 10154, attention: Corporate Secretary.

Our Board of Directors has nominated eleven current directors, Lamberto Andreotti, Giovanni Caforio, M.D., Lewis B. Campbell, James M. Cornelius, Laurie H. Glimcher, M.D., Michael Grobstein, Alan J. Lacy, Thomas J. Lynch, Jr., M.D., Dinesh C. Paliwal, Vicki L. Sato, Ph.D., Gerald L. Storch and Togo D. West, Jr., to serve as directors of Bristol-Myers Squibb. The directors will hold office from election until the 20152016 Annual Meeting.

A majority of the votes cast is required to elect directors. Any current director who does not receive a majority of votes cast must tender his or her resignation as a director within 10 business days after the certification of the stockholder vote. The Committee on Directors and Corporate Governance, without participation by any director tendering his or her resignation, will consider the resignation offer and recommend to the Board whether to accept it. The Board, without participation by any director tendering his or her resignation, will act on the Committee's recommendation at its next regularly scheduled meeting to be held within 60 days after the certification of the stockholder vote. We will promptly disclose the Board's decision and the reasons for that decision in a broadly disseminated press release that will also be furnished to the SEC on Form 8-K. If any nominee is unable to serve, proxies will be voted in favor of the remainder of those nominated and may be voted for substitute nominees, unless our Board of Directors provides for a lesser number of directors.

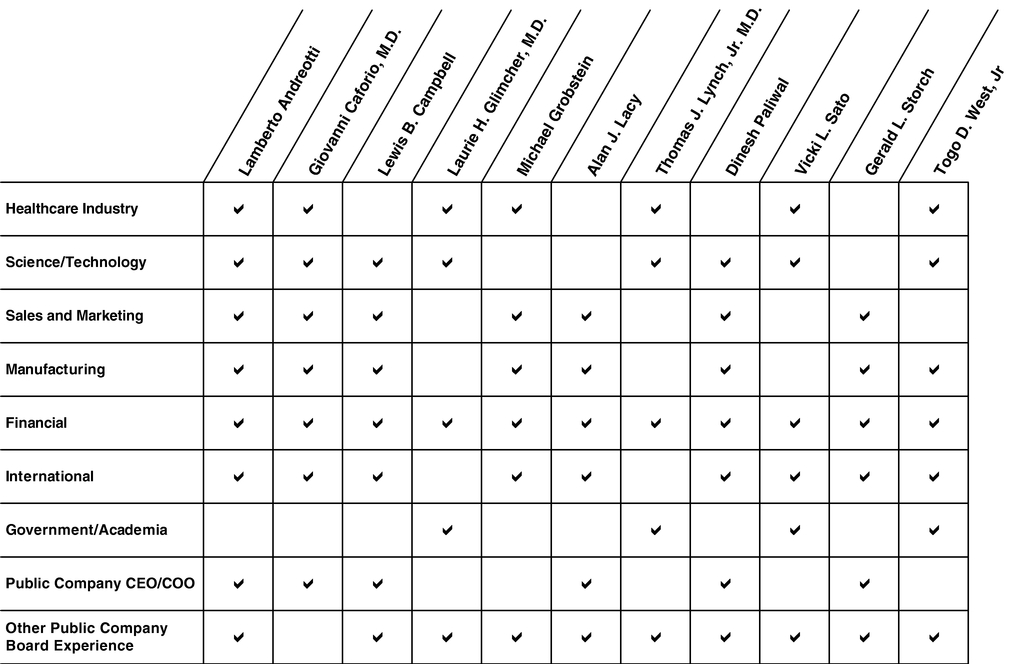

Listed below isThe following pages contain certain biographical information offor each of the nominees for election including his or her principal occupation and current directorships and former public company directorships held during the past 5 years of public companies and registered investment advisors and other business affiliations.years. Also included is a description of the specific experience, qualifications, attributes and skills of each nominee that led the Board to conclude that each nominee is well-qualified to serve as a member of our Board of Directors. The matrix below summarizes the variety of experiences, qualifications, attributes and skills of our nominees:

All Director Nominees Possess: | ||||||

• Leadership | • Sound business judgment | • Innovative thinking | • Integrity | |||

| ||||||

| | | |

| LAMBERTO ANDREOTTI Mr. Andreotti, age With his Mr. Andreotti is a Director of E. I. du Pont de Nemours and Company. | |

| | | |

| GIOVANNI CAFORIO, M.D. Dr. Caforio, age 50, has been our Chief Executive Officer-Designate since January 2015 and our Chief Operating Officer since June 2014. He served as Executive Vice President and Chief Commercial Officer from November 2013 to June 2014. From October 2011 to November 2013, he served as President, U.S. He held the With over 25 years of pharmaceutical industry experience, including more than 14 years at the company, Dr. Caforio has overseen the creation of a fully integrated worldwide commercial organization as part of our continued evolution into a diversified specialty biopharma company. A physician by training, Dr. Caforio has worked across many businesses within the company, including Europe and the U.S., and has a proven record of developing talented leaders with the diverse experiences and competencies needed for the continued success of the company. | |

| | | |

| | | |

| LEWIS B. CAMPBELL Mr. Campbell, age Mr. Campbell is a demonstrated leader with keen business understanding. With his executive level experience at Textron and Navistar, Mr. Campbell is uniquely positioned to help guide the company as we continue to build a strong foundation for success as a biopharmaceutical company. Furthermore, his first-hand knowledge of the many issues facing public companies and his current and past service as a member of each of our independent Board Committees position him well to serve as the Chair of the Committee on Directors and Corporate Mr. Campbell is on the Board of Directors of Sensata Technologies Holding N.V. | |

| | | |

|

| |

| LAURIE H. GLIMCHER, M.D. Dr. Glimcher, age Dr. Glimcher serves on the Board of Trustees of Cornell University, the Board of Overseers of Weill Cornell Medical College, the Memorial Sloan-Kettering Cancer Center Board of Overseers and on the Board of Trustees of the New York Blood Foundation. Dr. Glimcher also serves on the Scientific Advisory Boards of Cancer Research Institute, Health Care Ventures, Inc. Dr. Glimcher is an internationally known immunologist and physician who brings a unique perspective to our Board on a variety of healthcare related issues. Her expertise in the immunology area and her extensive experience in the medical field position her well to serve as a member of our Science and Technology Committee. Additionally, her experience as the Dean of a major medical school positions her well to serve as a member of our Audit Committee. Dr. Glimcher is a Director of Waters Corporation. | |

| | | |

| | | |

| MICHAEL GROBSTEIN Mr. Grobstein, age With over 30 years experience at a major auditing firm, Mr. Grobstein has extensive knowledge and background relating to accounting and financial reporting rules and regulations as well as the evaluation of financial results, internal controls and business processes. Mr. Grobstein's depth and breadth of financial expertise and his experience handling complex financial issues position him well to serve as a member of our Audit and Compensation and Management Development Committees. Mr. Grobstein is a Director of Mead Johnson Nutrition Company. During the last five years, Mr. Grobstein was a Director of Given Imaging Ltd. | |

| |

| | ||

| | ||

| ALAN J. LACY Mr. Lacy, age Mr. Lacy is a highly respected business leader with a proven record of accomplishment. He brings to the Board extensive business understanding and demonstrated management expertise having served in key leadership positions at Sears Holdings Corporation, including Chief Executive Officer. In addition, his experience as a senior financial officer of three large public companies provides him with a comprehensive understanding of the complex financial, legal and corporate governance issues facing large companies and positions him well to serve as Chair of our Audit Committee and a member of our Committee on Directors and Corporate Governance. Mr. Lacy is | |

| | | |

| | | |

| THOMAS J. LYNCH, JR., M.D. Dr. Lynch, age Dr. Lynch is an internationally recognized oncologist known for his leadership in the treatment of lung cancer with a special interest in personalized medicine. His experience as a practicing physician, During the last 5 years, Dr. Lynch was a Director of Infinity Pharmaceuticals, Inc. | |

| |

| | ||

| | ||

| DINESH C. PALIWAL Mr. Paliwal, age Mr. Paliwal brings to the Board extensive leadership, business and governance experience having served as a public company chief executive officer and a senior executive officer of various divisions of a multinational corporation. His engineering and financial background, together with his worldwide experience, particularly in emerging markets, provide him with a heightened understanding of the complex issues which arise in the global marketplace. In addition, Mr. Paliwal's prior service During the last 5 years, he was a Director of ADT Corporation and Tyco International, Ltd. | |

| | | |

| | | |

| VICKI L. SATO, PH.D. Dr. Sato, age Dr. Sato's extensive and distinctive experience in business, academia and science over more than Dr. Sato is a Director of PerkinElmer Corporation, | |

| |

| | ||

| | ||

| GERALD L. STORCH Mr. Storch, age A retail veteran with more than 20 years of experience, Mr. Storch provides the Board with valuable business, leadership and management insight, including expertise leading an organization with global operations, giving him a keen understanding of the issues facing a multinational business. These qualities make him a valued member of our Audit Committee. Additionally, his prior service on the compensation committee of another public company positions him well to serve as a member of our Compensation and Management Development Committee. Mr. Storch is the Non-Executive Chairman of the Board of Directors of Supervalu, Inc. | |

| | | |

| | | |

| TOGO D. WEST, JR. Secretary West, age Secretary West's legal, business and government experience provides the Board with a unique perspective of the issues facing our company. In his position as Secretary of Veterans Affairs, he was a member of the President's Cabinet, and oversaw the largest healthcare system in the country; and as Secretary of the Army, he was responsible for all Army activities, including the extensive system of Army medical centers around the world. In 2007, Secretary West was asked to co-chair the review of the delivery of healthcare at Walter Reed Army Medical Center and the National Naval Medical Center at Bethesda. With his keen understanding of the need to attract and retain talented employees and the public policy issues facing the healthcare industry, Secretary West is positioned well to serve as Chair of our Compensation and Management Development Committee and as a member of our Committee on Directors and Corporate Governance. Furthermore, his first-hand knowledge of the many issues facing public companies positions him well to serve as our Lead Independent Director effective May 5, 2015. Secretary West is a Director of FuelCell Energy, Inc. and Krispy Kreme Doughnuts, Inc. During the last 5 years, he was a Director of AbitibiBowater Inc. | |

| | | |

Communications with our Board of Directors

The Committee on Directors and Corporate GovernanceOur Board has created a process by which an interested party mayfor anyone to communicate directly with our Board, any committee of the Board, the non-management directors.directors of the Board collectively or any individual director, including our Chairman and Lead Independent Director, if any. Any interested party wishing to contact our non-management directorsBoard may do so in writing by sending a letter c/o Corporate Secretary, Bristol-Myers Squibb Company, 345 Park Avenue, New York, NY 10154.

Any matter relating to our financial statements, accounting practices or internal controls should be addressed to the Chair of the Audit Committee. All other matters should be addressed to the Chair of the Committee on Directors and Corporate Governance. Our Corporate Secretary or her designee reviews all correspondence and forwards to the addressee all correspondence determined to be appropriate for delivery. The Board has determined that certain items which are of a personal nature or not related to the duties and responsibilities of the Board should not be forwarded, including, but not limited to, junk mail and mass mailings (except those that may involve a reputational risk to the company); customer correspondence, including product complaints and inquiries; new product suggestions; resumes and other forms of job inquiries; opinion surveys or polls; business solicitations or advertisements; or obscene, threatening, harassing or similarly inappropriate materials. Our Corporate Secretary periodically forwards to the Chair of our BoardCommittee on Directors and Corporate Governance a summary of all such correspondence and copies of all correspondence that, in the opinion of our Corporate Secretary, deals with the functions of our Board or its committees, or that our Corporate Secretary otherwise determines requires Board attention.received. Directors may at any time review a log of the correspondence we receive that is addressed to members of the Board and request copies of any such correspondence. Our process for handling communications to our Board has been approved by the independent directors.

OurThe Principles adopted by our Board of Directors has adopted the Standards of Business Conduct and Ethics that setsset forth important company policies and procedures in conducting our business in a legal, ethical and responsible manner. These standards are applicable to all of our employees, including the Chief Executive Officer, the Chief Financial Officer and the Controller. In addition, the Audit Committee has adopted the Code of Ethics for Senior Financial Officers that supplements the Standards of Business Conduct and EthicsPrinciples by providing more specific requirements and guidance on certain topics. The Code of Ethics for Senior Financial Officers applies to the Chief Executive Officer, the Chief Financial Officer, the Controller, the Treasurer and the heads of major operating units. Our Board has also adopted the Code of Business Conduct and Ethics for Directors that applies to all directors and sets forth guidance with respect to recognizing and handling areas of ethical issues. The Standards of Business Conduct and Ethics,Principles, the Code of Ethics for Senior Financial Officers and the Code of Business Conduct and Ethics for Directors are available on our website at www.bms.com/ourcompany/governance. We will post any substantive amendments to, or waivers from, applicable provisions of our Standards of Business Conduct and Ethics,Principles, our Code of Ethics for Senior Financial Officers, and our Code of Business Conduct and Ethics for Directors on our website at www.bms.com/ourcompany/governance within two days following the date of such amendment or waiver.

Employees are required to report any conduct they believe in good faith to be an actual or apparent violation of our Codes of Conduct. In addition, as required under the Sarbanes-Oxley Act of 2002, the Audit Committee has established procedures to receive, retain and treat complaints received regarding accounting, internal accounting controls, or auditing matters and the confidential, anonymous submission by company employees of concerns regarding questionable accounting or auditing matters.

The Board has adopted written policies and procedures for the review and approval of transactions involving the company and related parties, such as directors, executive officers and their immediate family members. The policy covers any transaction or series of transactions (an "interested transaction") in which the amount involved exceeds $120,000, the company is a participant, and a related party has a direct or indirect material interest (other than solely as a result of being a director or less than 10 percent beneficial owner of another entity). All interested transactions are subject to approval or ratification in accordance with the following procedures:

As disclosed inThere were no reportable related party transactions during 2014 with any of our proxy statements fordirectors, executive officers or any of their immediate family members. However, BlackRock, Inc. (BlackRock), Wellington Management Group, LLP (Wellington) and The Vanguard Group (Vanguard) are each considered a "Related Party" under our 2012 and 2013 Annual Meetings, the Chairrelated party transaction policy because they each beneficially own more than 5% of our outstanding common stock. The Committee on Directors and Corporate Governance in consultation with the General Counsel,ratified and approved the following related party transaction in 2011 with our former director R. Sanders Williams, M.D., which approval was subsequently ratified by the Committee in 2012 (with Dr. Williams recusing himself from that portion of the meeting),transactions in accordance with our policy and Bylaws:

The Committee on Directors and validate novel targets in Alzheimer's disease. Dr. Williams did not participate inCorporate Governance ratified the above relationships on the basis that these projects while he was a memberentities' ownership of our Board. The agreement was negotiated on an arm's length basis and Dr. Williams was not involvedstock plays no role in the decision-making processbusiness relationship between us and them, and that the engagement of either partyeach entity was on terms no more favorable to them than terms that would be available to unaffiliated third parties under the transaction nor was he involved in any communications between the company and Gladstone.

Additionally, as disclosed in our proxy statement for our 2013 Annual Meeting, the following related party transaction with our former director Louis J. Freeh was deemed to be pre-approved in accordance with our policy and Bylaws:

Pepper Hamilton in 2012 and approximately $5.5 million in 2013. Mr. Freeh did not initiatesame or negotiate the services provided by Pepper Hamilton and the relationship with Pepper Hamilton was entered into in the ordinary course of business prior to Mr. Freeh becoming a partner of the firm. In February 2013, Mr. Freeh was named Chair of Pepper Hamilton.similar circumstances.

Availability of Corporate Governance Documents

Our Corporate Governance Guidelines (including the standards of director independence), Standards of Business Conduct and Ethics,Principles, Code of Ethics for Senior Financial Officers, Code of Business Conduct and Ethics for Directors, additional policies and guidelines, committee charters and links to Reports of Insider Transactions are available on our corporate governance webpage at www.bms.com/ourcompany/governance and are available to any interested partyanyone who requests them by writing to: Corporate Secretary, Bristol-Myers Squibb Company, 345 Park Avenue, New York, New York 10154.

2013 Director Compensation Program

We aim to provide a competitive compensation program to attract and retain high quality directors. The Committee on Directors and Corporate Governance annually reviews our directors' compensation practices and compares them against the practices of the companies in our peer group.practices. The Committee submits its recommendations for director compensation to the full Board for approval. Our employee directors do not receive any additional compensation for serving as directors.

In 2012,2013, management engaged an outside consultant, Frederic W. Cook & Co., Inc. (FWC), to review market data and competitive information on director compensation. The Committee requested that FWC analyze the appropriateness of continuing to use the company's executive compensation peer group as the primary data point in determining director compensation. FWC recommended that the executive compensation peer group should be the primary source for determining director compensation. The following companies were in our peer group: AbbVie Inc., Amgen Inc., Biogen Idec Inc., Celgene Corporation, Eli Lilly & Company, Gilead Sciences Inc., Johnson & Johnson, Merck & Co. and Pfizer, Inc.

As further described below, our director compensation program in 2014 was positioned at the median of the executive compensation peer group. Consistent with our desire to attract and retain highly skilled and experienced directors, the Committee on Directors and Corporate Governance, in consultation with FWC, determined that it was appropriate to continue to target director compensation at the median of the companies in our executive compensation peer group for 2013. The following companies were in our peer group: Abbott Laboratories (prior to AbbVie Inc. separation), Amgen Inc., Biogen Idec Inc., Eli Lilly & Co., Gilead Sciences Inc., Johnson & Johnson, Merck & Co. and Pfizer, Inc. As further described below, our director compensation program in 2013 was positioned at the median.2014. The Committee believes the total compensation package for directors we offered in 20132014 was reasonable, and appropriately aligned the interests of directors to stockholders by ensuring directors have a proprietary stake in our company.

In December 2014, the Committee on Directors and Corporate Governance engaged FWC to review market data and prepare analyses that compared our director compensation program against our executive compensation peer group. The componentscompanies in the executive compensation peer group are the same as the companies used to evaluate 2014 director compensation set forth above. Our director compensation program in 2014 was positioned at the median for the executive compensation peer group. Based on this analysis and FWC's recommendation in January 2015 that no changes need to be made to the compensation program for our non-employee directors in 2015, the Committee determined that no changes were necessary at that time. In connection with the organizational and Board leadership changes described beginning on page 8, FWC was subsequently asked to consider Non-Executive Chairman and Lead Independent Director compensation for Mr. Andreotti and Secretary West, respectively. FWC recommended, and the Board approved, compensation as further described below.

The Components of our standard non-management directors' compensation for 2013 were as follows:Director Compensation Program

Cash Compensation

In 2013,2014, our non-management directors were entitled to receive the following cash compensation:

In addition, Mr. Campbell, as the Lead Independent Director through March 3, 2014, received a pro rata amount of an annual cash retainer of $30,000. As of May 5, 2015, Secretary West will be entitled to receive a pro rata amount of an annual cash retainer of $35,000 as Lead Independent Director, which is the median among our peers. The amount of the annual cash retainer paid to Mr. Campbell was set in 2010 and the increase for Secretary West is based on a review of current market data of our peer group.

Deferral Program

A non-management director may elect to defer payment of all or part of the cash compensation received as a director under our company's 1987 Deferred Compensation Plan for Non-Employee Directors. The election to defer is made in the year preceding the calendar year in which the compensation is earned. Deferred funds may be credited to one or more of the following funds: a 6-month United States Treasury bill equivalent fund, a fund based on the return on the company's invested cash or a fund based on the return on our common stock. Deferred portions are payable in a lump sum or in a maximum of ten annual installments. Payments under the Plan begin when a participant ceases to be a director or at a future date previously specified by the director.

Equity Compensation

On February 1, 2013,2014, all non-management directors serving on the Board at that time received an annual award of deferred common share units valued at $160,000 under the 1987 Deferred Compensation Plan for Non-Employee Directors. These deferred common share units are non-forfeitable at grant and are settleable solely in shares of company common stock. A new member of the Board who is eligible to participate in the Plan receives, on the date the Director joins the Board, a pro-rata number of deferred common share units based on the number of share units payable to participants as of the prior February 1.

Share Retention Requirements

All non-management directors are required to acquire at least $300,000 worth of BMS shares and/or deferred share units within three years of joining the Board and to maintain this ownership level throughout their service as a director. We require that at least 25% of the annual retainer be deferred and credited to a deferred compensation account, the value of which is determined by the value of our common stock, until a non-management director has attained our share retention requirements.

Charitable Contribution Programs

Each director who joined the Board prior to December 2009 participates in our Directors' Charitable Contribution Program. Upon the death of a director, we will donate up to an aggregate of $500,000 to up to five qualifying charitable organizations designated by the director. Individual directors derive no financial or tax benefit from this program since the tax benefit of all charitable deductions relating to the contributions accrues solely to us. In December 2009, the Board eliminated the Charitable Contributions Program for all new directors.

Also, each director was able to participate in our company-wide matching gift program in 2013.2014. We matched dollar for dollar a director's contribution to qualified charitable and educational organizations up to $30,000. This benefit was also available to all company employees. In 2013,2014, each of the following directors participated in our matching gift programs as indicated in the Director Compensation Table below: Messrs. Campbell, Cornelius, Freeh,Campbell, Grobstein, Lacy and WestPaliwal and Dr. Williams.Glimcher.

Compensation of the Non-Executive Chairman

On May 4, 2010, Mr. Cornelius retired as our CEO and became ourOur Non-Executive Chairman of the Board. As Non-Executive Chairman, Mr. Cornelius has significantly greater responsibilities than other directors, including chairing the Office of the Chairman to meet on a regular basis with the CEO on the most critical strategic issues and transactions, serving as a liaison between the CEO and the independent directors, frequently discussing the strategy and direction of the company with senior management, and serving as a non-voting member, ex-officio, of the Audit Committee, Committee on Directors and Corporate Governance and the Compensation and Management Development Committee.

Mr. Cornelius has served as our Non-Executive Chairman since May 4, 2010, when he retired as our CEO. In addition to the standard Board compensation that all non-employee directors receive, Mr. Cornelius receives an annual Non-Executive Chairman retainer of $200,000, paid quarterly, of which 50% is paid in cash and 50% in shares of company common stock.

2014 Director Compensation

As described in more detail beginning on page 8, Mr. Cornelius will retire as our Non-Executive Chairman and a member of our Board at our 2015 Annual Meeting of Stockholders on May 5, 2015. The Board has elected Mr. Andreotti to become Executive Chairman of the Board effective May 5, 2015 and Non-Executive Chairman of the Board effective August 3, 2015 following his retirement as an officer of the Company. In December 2013,addition to the Committee on Directorsregular cash Board retainer and Corporate Governance engaged FWC to review market data and prepare analyses that compared our director compensation program against our peer group. The companies in this peer group are the same as the companies in the primary peer group thatannual equity award, Mr. Andreotti will receive an annual Non-Executive Chairman retainer of $200,000, paid quarterly, of which 50% will be usedpaid in cash and 50% in shares of the Company's common stock. As our Non-Executive Chairman, Mr. Andreotti will continue to work closely with the new Chief Executive Officer for evaluating 2014 executive compensationa transition period and are listedhe will receive a Transitional Non-Executive Chairman retainer of $225,000 on page 32. Our director compensation programan annualized basis, paid quarterly, of which 50% will be paid in 2013 was positioned atcash and 50% in shares of the medianCompany's common stock. The Company will also provide Mr. Andreotti with office space, supplies and administrative support for the executive compensation peer group. Based on this analysis and FWC's recommendation in January 2014 that no changes need to be made to the compensation program for our non-employee directors in 2014, the Committee determined that no changes were necessary at that time.Company-related work.

Director Compensation Table

The following table sets forth information regarding the compensation earned by our non-employee directors in 2013. Dr. Lynch, who joined our board on January 1, 2014, did not receive any compensation for 2013.2014.

Name | Fees Earned or Paid in Cash(1) | Stock Awards(2) | Option Awards(3) | All Other Compensation(4) | Total |

| | Fees Earned or Paid in Cash(1) | | Stock Awards(2) | | Option Awards(3) | | All Other Compensation(4) | | Total | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | ||||||||||||||||

L. B. Campbell | $ | 160,000 | $ | 160,000 | $ | 0 | $ | 30,000 | $ | 350,000 | L. B. Campbell | $ | 135,242 | $ | 160,000 | $ | 0 | $ | 23,000 | $ | 318,242 | |||||||||||||

J. M. Cornelius(5) | $ | 190,000 | $ | 260,000 | $ | 0 | $ | 30,000 | $ | 480,000 | J. M. Cornelius(5) | $ | 190,000 | $ | 260,000 | $ | 0 | $ | 30,000 | $ | 480,000 | |||||||||||||

L. J. Freeh(6) | $ | 17,823 | $ | 160,000 | $ | 0 | $ | 30,000 | $ | 207,823 | ||||||||||||||||||||||||

L. H. Glimcher, M.D. | $ | 120,000 | $ | 160,000 | $ | 0 | $ | 0 | $ | 280,000 | L. H. Glimcher, M.D. | $ | 120,000 | $ | 160,000 | $ | 0 | $ | 20,000 | $ | 300,000 | |||||||||||||

M. Grobstein | $ | 120,000 | $ | 160,000 | $ | 0 | $ | 30,000 | $ | 310,000 | M. Grobstein | $ | 120,000 | $ | 160,000 | $ | 0 | $ | 30,000 | $ | 310,000 | |||||||||||||

A. J. Lacy | $ | 122,500 | $ | 160,000 | $ | 0 | $ | 30,000 | $ | 312,500 | A. J. Lacy | $ | 122,500 | $ | 160,000 | $ | 0 | $ | 30,000 | $ | 312,500 | |||||||||||||